Coronavirus business support measures September 2020

Rishi Sunak today announced that the government will cover up to two thirds of workers’ wages if their hours have been reduced due to the coronavirus pandemic. It is hoped that the ‘Jobs Support Scheme’ will help to reduce the millions of job losses expected when the furlough scheme ends on October 31st 2020.

Announced as part of a wider Winter Economy Plan in the Commons this afternoon, Sunak also covered other measures including pushing back the deadline for the business loan support schemes and an extension to the VAT cut for the hospitality industry until March 2021. Read on for more details of the measures announced today, and please bookmark this page as we will be updating it as more details become available.

Jobs Support Scheme

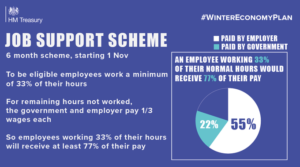

The government will cover up to two thirds of workers’ wages if their hours have been reduced due to the coronavirus crisis. The scheme will replace the furlough scheme, and will run for 6 months from November 1st 2020.

- Anyone who is employed as of September 23rd 2020 and has had their hours reduced as a result of coronavirus can be put on the scheme

- Employers will pay staff for the hours they do work and for the hours they can’t work, the government and the employer will each cover one third of the lost pay

- The grant will be capped at £697.92 per month

Which businesses are eligible?

- All small and medium sized businesses, even if they didn’t use the furlough scheme

- Larger businesses will only be eligible when their turnover has fallen

- Employers can also claim the Jobs Retention Bonus worth £1,000 if they keep staff in work through to January 31st 2021

Which employees are eligible?

Only those on the PAYE payroll. Self-employed workers have been given more time to pay their tax bill.

How can I apply?

It is likely that employers will put employees onto the scheme in much the same way as they did with furlough, however the details have yet to be released.

When will furlough end?

The furlough scheme has been winding down since July and is due to end completely on October 31st 2020. The Jobs Support Scheme has been designed as a replacement for furlough in the hope of reducing redundancies.

VAT and income tax

- The 15% emergency VAT cut (down to 5%) for the tourism and hospitality industries will be extended to 31st March 2021

- Businesses who deferred their VAT bills will be able to pay back their taxes in 11 smaller interest-free instalments following 31st March 2021

- Self-assessment tax payers will be able to defer tax payments to January 2022

Business interruption loans

- Business Bounce Back loans will have their repayment periods extended from 6 to 10 years and in some cases, payments deferred for up to 6 months.

- The deadline for the government’s coronavirus loan schemes has been extended to the end of November 2020

- Businesses struggling can choose to make interest only payments for six months and those ‘in real trouble’ can apply to suspend repayments altogether for six months

Self-employed support

- The self-employed grant scheme is being extended on similar terms to the jobs support scheme

- Businesses will be eligible for the new help if they previously qualified for the self-employment income support scheme (SEISS) and if they’re actively trading

- The grant will cover three months’ worth of profits for the period from November to the end of January

- It will cover 20% of average monthly profits up to a total of £1,875

- A further grant will be available to the self-employed to cover February 2021 to the end of April 2021

At Vantage Accounting, we pride ourselves in supporting and advising our clients whenever they need us, so please do get in touch if you have any questions. If you are not yet a client, get in touch today for more information about our fixed fee, all-inclusive small business accounting packages.

Note: All the information and advice in this blog post was correct at the time of writing.